How to File a Claim with State Farm

If you pay for a State Farm auto insurance policy, you must notify your agent if you are in a collision. But before you file a claim with State Farm, be sure you know what to expect from the process.

The Canton car accident lawyers at Geiger Legal Group, LLC have extensive experience helping car accident injury victims deal with insurance companies. To learn more about State Farm accident claims, contact us today for a free consultation.

What Should I Do After Being Injured in a Car Crash?

Your actions immediately after a car crash could help or hurt your chances of recovering compensation later if you need to file a claim against your or another driver’s insurance policy. If you are involved in an accident, consider taking these steps:

- Call the authorities

- Exchange information with the other driver

- Seek medical attention immediately

- Document the scene by taking pictures and videos

- Ask witnesses for their contact information

- Report the accident to your insurer

- Keep copies of your medical bills and repair receipts

- Follow your medical provider’s treatment plan

- Consult with an attorney

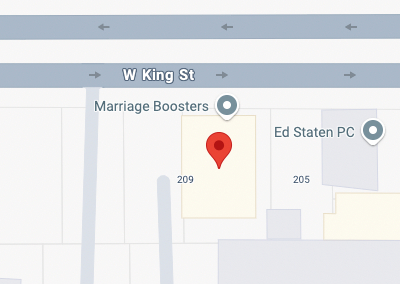

What Is the State Farm Claim Process?

State Farm offers accident victims a few different ways to file a claim. You can visit the State Farm website or mobile app and begin the claim process online. You could also call your local State Farm representative or State Farm’s toll-free number. If you are unsure who your representative is, check your most recent billing statement.

The first step in filing a State Farm accident claim is giving your agent basic information about the crash. Keep this conversation short, to the point, and factual. Your agent should also give you a claim number. Write this number down for future reference.

Should a Car Accident Victim Speak with a State Farm Insurance Representative?

State Farm uses an effective marketing strategy. They want you to believe they are a good friend and neighbor who will help when an accident happens. In reality, they are a for-profit business that needs to collect premiums and pay as little as possible for claims against those policies to make money.

You should be aware that what you say to an insurance agent or adjuster could potentially be used to diminish the value of your claim. Keep your information accurate and factual when talking to a State Farm representative. Never apologize, speculate, or exaggerate, and answer all questions truthfully. Try to avoid giving a recorded statement. Never sign paperwork without first allowing an attorney to review the documents.

It’s also crucial to note that you don’t have to handle the communication with State Farm representatives yourself. When you hire an attorney to represent you, you can let them take over all discussions with the State Farm agents.

What Should I Expect After Making a Claim with State Farm?

In a few days to a few weeks, an agent should notify you of the status of your claim, whether it was approved or denied. If approved, they may review with you what your claim is worth. Remember, you may have a deductible to satisfy before you can settle your claim.

You have the right to appeal the decision if your claim is denied. To appeal, you must write a letter to State Farm outlining why you believe the claim should be paid and include supporting evidence and documentation.

Hire a Car Accident Attorney to Handle Your State Farm Accident Claim

You don’t need to navigate the State Farm claim process alone. An experienced car accident attorney with Geiger Legal Group, LLC can manage communication with your insurer and gather evidence to strengthen your claim. Contact our office today for your free consultation.